Open for business

The traditional health care delivery system has been shifting away from the all-encompassing, full-service hospital for several years. Major hospitals are becoming more focused on the acute and critical patient population, which is causing most other services to shift to outpatient settings. These services will be housed in a variety of facilities from large freestanding medical office buildings (MOBs) on medical campuses to small express clinics.

The traditional health care delivery system has been shifting away from the all-encompassing, full-service hospital for several years. Major hospitals are becoming more focused on the acute and critical patient population, which is causing most other services to shift to outpatient settings. These services will be housed in a variety of facilities from large freestanding medical office buildings (MOBs) on medical campuses to small express clinics.

One common denominator will be a focus on the retail amenities and branding. Outpatient services will continue to pop up in small retail centers, become part of large health care malls and the services in the MOB will become more retail inclusive.

Underlying factors

As the baby boomers begin to retire, a large increase in the Medicare population may put stress on hospital bed availability. Unlike the World War II generation, the baby boomers are expected to remain physically active into their 80s. The lifestyle demands of this bubble will require medical services that are more competitive, attractive and affordable.

There also is a real concern about the unsustainable cost of inpatient care and treatment without proportionate gains in quality and health. Trends are shifting toward preventive care and health maintenance rather than treatment-based care. The accountable care organization will entail a more collaborative group of providers working to support wellness and preventive care.

Moreover, the United States has become a fast-paced, immediate gratification society with high expectations. It is becoming all about the patient experience and making access to health care convenient and readily accessible.

New access models

There are several models of care emerging simultaneously based on a health system's community needs and assets. These include small family and retail-based express clinics, medical malls and wellness centers.

Retail-based express clinics and community-based clinics. Located in proximity to activities of daily life such as walking and shopping paths, these facilities are focused on quick-response, preventive measures like sports physicals, immunizations and minor illness, and injuries.

According to a Rand Corp. study of data for 13.5 million commercially insured patients younger than 65, the typical retail clinic user is female, between 18 and 44 years old, with median household income greater than $59,000 per year. Providers are making health care easy to access and affordable, anticipating that it will be used more frequently and, thereby, minimizing the risk of simple acute conditions becoming chronic or severe.

Access and convenience is the key for these small clinics. Hours typically are extended and care is provided by nurse practitioners with access to a medical director. Walmart, Walgreens and MinuteClinic by CVS are some of the early express clinics.

Likewise, small family clinics are becoming more mainstream. In Bloomington, Minn., for example, one is conveniently located in an urban historic district retail location among contemporary new condominiums.

Medical malls. Not only do medical malls help curb costs by focusing efforts around an outpatient model, but they create a revenue stream by offering new opportunities. Some medical malls have been taking over abandoned big box stores or strip malls.

Full-service outpatient buildings and medical malls include one-stop shopping with multiple retail amenities and wellness options like Shelby Macomb (Mich.) Medical Mall. Before it was built, this 90,000-square-foot medical mall was 90 percent leased. Hospital officials saw it as a convenient way to combine specialties in one location.

Wellness centers. Obesity has become one of the most serious public health problems in the United States. Coinciding with access to health care also must be the access to wellness, such as exercise and good nutrition.

The focus of wellness centers is on motivating people to remain healthy as opposed to seeking medical attention when they begin to lose health. Wellness centers may have a variety of specialty clinics as well as alternative care options such as acupuncture and massage therapy, and partial fitness centers or full centers that include swimming pools.

Mayo Clinic's new healthy living center in the Mall of America in Bloomington, Minn., provides an opportunity for clients to define their own wellness goals, access interactive information and explore resources dedicated to health. This personalized engagement is part health and wellness experience, part retail store. Similarly, the Anschutz Health and Wellness Center in Aurora, Colo., is an example of a freestanding health and wellness center combining specialty service clinics with a health club, health research and connective wellness options such as massage therapy and acupuncture.

|

| Northwestern Memorial Hospital, Chicago, provides focused attention to retail amenities, including a variety of dining options for patients' families, staff, and the general public. |

Impact on interior design

As the shift from inpatient to outpatient care grows, the opportunity for redefining the delivery of care also grows. The large medical campuses will not go away, but these projects likely will slow down as less critical care is transferred to outpatient facilities. More outpatient centers will grow up to handle the services being divested by hospitals.

Health care organizations are focusing on connectivity with their community base through urban and suburban clinics. As health systems consider the opportunities for community outreach through the design and planning of smaller clinics and express clinics, they will be considering how this can impact and strengthen their brand within the communities. Design teams will become integral in assisting with this extension of the health system branding through enhancements or simply ensuring the continuation and celebration of the existing branding.

With a heightened focus on return on investment, cost-effective real estate solutions will be a factor in addressing challenges ahead. Real estate experts indicate that many health care systems are planning networks that add satellite facilities in diverse locations with a variety of services and service models to allow them to remain competitive in a cost-effective way.

Some of these may create new life for failed, abandoned urban and suburban retail centers suffering from the economic downturn. Empty retail anchor spaces are obvious and cost-effective solutions for both real estate segments.

Urban planners are focusing their efforts on creating work, live and play communities that allow neighbors to walk through their days rather than driving. The goal for the urban clinic is to connect with the community and be convenient for customers. Communities want medical services in their neighborhoods. Multifamily residential buildings will begin to have small express clinics in their street-level retail areas along with coffee shops and small cafes. Smaller express clinics also may be sprinkled throughout retail areas as well as civic and community centers such as libraries and recreation centers.

Health facilities will be focusing on family support and convenience as a part of the patient focus. Hospitals will be providing more retail offerings within their campuses to maximize the patient experience by keeping them entertained and on-site to dine and shop. For instance, Toronto's University Health Network devotes 50,000 square feet of space to retail, restaurants and shopping. Northwestern Memorial Hospital in Chicago has 14,000 square feet of retail space, including multiple dining options, Starbucks and Barbara's Bookstore.

Likewise, existing MOBs will be reinvented to provide more broad-based services — which will become a catalyst for future remodel and Âexpansion work. Outpatient surgery centers, outpatient cancer centers, dental centers and family health clinics will be encompassing retail opportunities within the facilities to cater to client and family needs. Coffee shops and boutiques are familiar features, but visitors can expect more full-service cafes, spas, and other retail offerings in the future.

Health care design teams will need to encompass a broad base of services. Along with the understanding of the complex codes and other requirements of the health care industry, design teams will need to become familiar with a broad base of retail and recreational specialties or will need to bring retail and recreational specialists into the team structure for these specific areas. There will be a more collaborative approach as teams work to cover the retail, recreational and specialty aspects of the space needs.

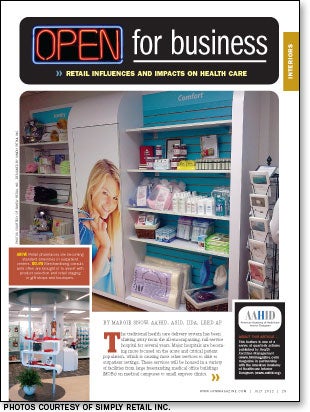

The ambiance of the active, higher-energy retail centers will begin to impact the medical centers as health facilities focus on more aspects of family service. The retail space within the various health centers will become a community gathering area. The design focus will be more colorful and active within these spaces. Vibrant lighting, signage and store fronts will entice people into the shops as the public spaces become a community within a community.

Retail design culture

The design lessons of the retail culture will need to be understood and incorporated into the health care model. Whether clinics are freestanding MOBs, smaller clinics incorporated into municipal facilities as retail clinics or into retail settings in shopping centers, the design challenge will be to establish branding identity while attracting clients, informing and calming anxieties.

Designers in the health care industry must keep abreast of the trends and expectations of building owners, caregivers and patients by incorporating strategies on the front end of the planning and design process that support branding and high performance as well as overall patient, family and staff well-being.

Better communication, more varied teams and more definitive studies will be the tools to carry the industry into the next phase of design that support the art of healing in a multitude of service locations.

Margie Snow, AAHID, ASID, IIDA, LEED AP, is principal at Gallun Snow Associates in Denver. She can be reached at msnow@gallunsnow.com.

| Sidebar - Retail design elements to consider |

| Facade design — whether a store front in a mall, on a street or within a large health care facility — is the best way to communicate branding. A facade should be visible and eye catching. Signage, windows, window displays, lighting, materials and color all work together to reinforce the brand identity. In retail settings, the facade competes with the glitz of stores all clamoring for attention. The facade is the prelude to the entry itself, which sets the expectation for the experience within. The entry should be a culmination of the brand identity and give a glimpse of what is inside. Once inside the space, understanding how to use the retail elements of design can help make the health care space an effective part of the brand message and set the stage for the specific clinic practice or the retail experience. When selecting materials, there is always a balancing act between capital costs, long-term durability and aesthetic appeal. In retail settings, the first cost is often the most important one. However, health care designers must consider life-cycle costs that include first cost and maintenance over the lifetime of the products as well as the replacement timeline. Flooring is an important material because it will get the most wear and "ugly out" if not properly maintained. Consideration must be given to the type of traffic because an interior space will not require as heavy duty a material as a space handling traffic directly from the exterior. Type of flooring also impacts aesthetics. A carpeted space tends to be quieter and softer, but can be vibrant based on colors selected. Carpeting underfoot is often a welcome feeling for patients, families and staff who may be weary, but it is not always an appropriate material for health care environments. Hard-surface flooring — especially a shiny hard surface like terrazzo or granite tile — will give a lively and energetic feel to the space. Finally, a wood-look vinyl plank floor may be an appropriate option for areas not requiring seamless flooring. This provides a warm welcome and is quieter and more slip-resistant than stone, tile or terrazzo. Wall finishes — whether painted or a combination of paint and millwork or stone detail — can convey either a sense of a temporary space or a more upscale, long-term commitment to the space. Polished plaster coatings can be an elegant and exciting way to add color and activity to a wall that must remain flat and washable. In public areas, wood, stone, tile and metal are great resources for creating drama with texture. The balancing act is to understand which finishes are appropriate to meet codes and allow the space to be maintained adequately. Ceilings can make or break a retail space. It is important to look for areas to highlight within the entry and other feature areas of the space to create a sense of transition throughout and make the space exciting. There are a number of materials to add interest, including wood or wood-look ceiling tiles, perforated metal or acoustical ceiling "clouds," acrylic panels and painted soffits. Even leaving the ceiling exposed in areas can be an option. The key is to understand the codes and the needs of the space and to use ceilings as an important element to create motion and interest. Lighting is the final element that is inherent in the success or failure of the finish treatments. Lighting can be used to make a space sparkle and dance, to accent a feature element, to subdue and soften an area, to help guide traffic flow and, of course, to highlight task areas. If the interior designer does not have a good grasp of lighting options and lamping choices there are many good lighting designers that can be added to the team. The key to a successful design is communication and vision. The main goal for an interior designer is to understand the health care organization and its vision and to know how to work with the materials and design team partners. |