2016 Hospital Construction Survey

About this survey:

Health Facilities Management (HFM) and the American Society for Healthcare Engineering of the American Hospital Association surveyed a random sample of 3,125 hospital and health system executives to learn about trends in hospital construction. The response rate was 6.6 percent. HFM thanks the sponsors of this survey: Modular Services Company and Ecore Commercial Flooring.

The rise of consumerism and its influence on health care facilities came through loud and clear from respondents to Health Facilities Management’s 2016 Hospital Construction Survey, which was conducted in cooperation with the American Society for Healthcare Engineering.

More than 86 percent of survey respondents said that patient satisfaction is “very important” in driving design changes to health facilities and/or services. Another 12 percent said patient satisfaction is “somewhat important“ in driving changes. No respondents said patient satisfaction was “not at all important“ in design.

And with increasing frequency, hospitals are including patients and community members in the design process. Some 63 percent of respondents said they include the public in the design process.

“Those numbers are off the charts compared to previous years,“ says Andrew Quirk, senior vice president and national director at Skanska USA. “If you look at the whole survey, the exciting thing to me is that it really appears the Affordable Care Act is beginning to take root in the built environment.”

More than 200 hospitals nationwide responded to the survey, about evenly split among rural, urban and suburban facilities. Roughly half of respondents were general medicine and surgical facilities and a quarter had 500 or more beds. The survey included such specialty hospitals as psychiatry, children’s and cancer treatment centers. The survey was conducted in the fourth quarter of 2015.

Experience matters

Providing an excellent patient experience is more closely tied to reimbursement than ever before. Since 2012, Medicare payments are based in part on patient satisfaction scores for the HCAHPS survey.

Hospitals today are more mindful of design elements that can affect their HCAHPS scores, including noise reduction, privacy and personal controls at the bedside, the survey respondents said. More than half of respondents said they use noise-reduction construction materials to improve patient experience.

Privacy and comfort also ranked high in design trends to improve patient experience, with 66 percent of respondents saying they are converting semiprivate rooms to private and 49 percent saying they are increasing the square footage of patient rooms. Three-fourths are providing wireless Internet access and more than half of respondents offer greater patient control over lighting, temperature and window shades.

However, Quirk and others say the trend toward bigger patient rooms is starting to reverse, with more and more providers seeking to reintroduce smaller patient rooms. “The health care space has grown unchecked over the past 10 years,” Quirk says. “Most clients are questioning this. We see the trend moving closer to minimum square footages.”

Partnering with patients

HCAHPS is just one measure to consider in patient satisfaction as it relates to facility design and construction, says Joe Sprague, principal and senior vice president of HKS in Dallas.

“Hospitals are also considering patient safety issues such as fall prevention,“ Sprague says. “Fall reductions are one of the most prevalent patient safety issues in the design of facilities today.”

Medicare and many private insurers classify inpatient falls as a “never event“ that is no longer reimbursable. Some 61 percent of respondents said they use design strategies to mitigate injury from falls. Half said they use patient lifts in transport to the bedside.

More than ever before, hospitals are including patients and community members in facility design decisions. Some 63 percent of survey respondents said they include patients or community members during the design process for new facilities.

Some design firms have incorporated patient experience studies into the design process, says Randy Keiser, national health care director at Turner Construction Co. in Nashville, and he believes more will do so in the future. Additionally, some hospitals and health systems have created new “chief patient experience officer” roles in the C-suite to be advocates for changes that include patients and communities.

Of the 63 percent of respondents who said patients or community members are involved in the design development, 79 percent offer feedback prior to design development. Sixty-six percent offer feedback during design development and 26 percent use patients or community members to test live mock-ups.

Some experts saw these numbers as encouraging, but felt they were high compared with what they see.

“That kind of surprised me to see this register so high,“ Quirk says, noting that his firm does live mock-ups for hospital staff. Overall, he says the trend toward involving patients in the design process likely will grow. “If the patient is the center of the universe for health care, it makes sense to involve them,“ Quirk says. “I would expect these numbers to creep up in the coming years.”

The survey responses reflect what’s going on in the industry, namely that providers are trying to figure out what makes patients satisfied with the care and experience they receive at a hospital.

“There is a lack of recognized research about facility attributes that can influence patient satisfaction directly, although organizations like the Center for Health Design have done some good work,“ says Patrick Duke, managing director, CBRE Healthcare. “The perceptions from patients of what a facility should look like and the care it should support can vary widely based on geography and culture.”

Renovation rules

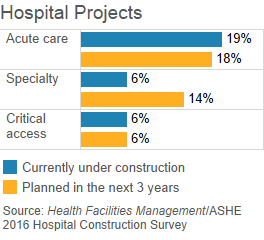

It appears that the industry is moving away from large-scale new construction, according to survey results. While 70 percent of respondents said they have projects currently under construction or planned in the next three years, a full three-fourths of those were expansions or renovations.

Out of responding acute care hospitals, less than 10 percent had new construction projects underway or in the works, and about 17 percent had replacement projects underway or in the works over the next three years.

The cost of replacing facilities could be driving this, says Keiser of Turner Construction. Average new hospital construction costs, excluding equipment, is about $400 per square foot. In New York City, it is about $1,200 per square foot.

“The big replacement hospitals we used to see are not happening as much,” Keiser says. “The challenge we are seeing is an increased need for critical care beds and too many medical-surgical beds, so there is bed conversion going on.”

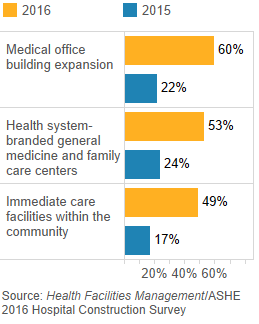

Medical office building and ambulatory care projects also are popular, as patients with less acuity shift to an outpatient setting. About 35 percent and 21 percent, respectively, said they had medical office and ambulatory care outpatient projects underway or planned in the next three years.

Other top services and departments being added or modernized were imaging, emergency departments (EDs) and surgery, with 15 percent of respondents in each category saying they have these projects underway.

Seventeen percent of respondents said they have urgent care projects underway or planned in the next three years. Experts said they expected this number to be higher. One reason is because urgent care facilities allow hospitals to free up space in their EDs for the very sick or injured while still capturing those who require same-day care, says Charles Maggio, managing director of the Northeast for CBRE Healthcare.

“I think we are going to see this explode,“ Maggio says of system-branded outpatient urgent care centers. “It’s relatively inexpensive and providers can do a short-term lease. We are seeing a lot of clients talking about it. This should also result in a corresponding decrease in emergency department expansions.”

Targeted upgrades

Efficiency improvements that topped the survey included replacing or upgrading major building services and equipment like air handlers and ventilation systems, electrical switches and plumbing fixtures. A full 61 percent of respondents said they either have upgraded or replaced air handlers and ventilation systems over the last two years, are doing so now or plan to within the next two years.

Maggio says that these results on air handlers could be misleading because health systems typically have to update one or two air handlers per year as part of their capital program, but not all of them. “It gives the impression that everyone is updating [all] their air handlers, but that is not true,“ he says.

Others said that the large air handler response rate could be, in part, reflecting the broader trend of patient satisfaction. Some hospitals are upgrading air systems to allow for greater temperature control at the bedside.

“There is a move to self-control and ownership of air in the space, but that move is slow because it is a very expensive one and it represents a wholesale redesign,“ Quirk says. “I think a lot of this is aging infrastructure coming due.”

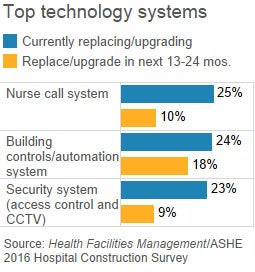

A priority for patient safety emerged when survey respondents were asked what technology is being replaced or upgraded. Nurse call systems, fire alarms, security systems and patient monitoring systems all ranked highly.

By contrast, electronic health records ranked low among respondents, probably reflecting that most facilities adopted such systems relatively recently, experts say.

Experts were encouraged that 45 percent of respondents said they had updated their master plans within the past 12 months, up from 42 percent a year ago. But they said they would expect to see more commissioning (audit to review performance of building energy systems), as 68 percent said they conduct commissioning. Additionally, just 34 percent of respondents said they use building information modeling (BIM) for facilities operations, disappointing some experts.

“I think BIM is one of the huge opportunities for the client to get control over the built environment after the contractor and the design team leave,“ Quirk says.

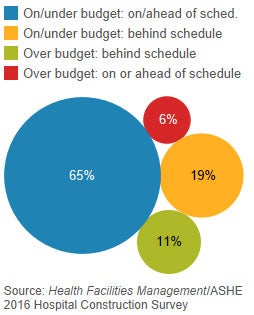

Nearly two-thirds (65 percent) of recently completed construction projects are on or under budget and/or on or ahead of schedule. This is a sharp contrast to last year’s survey results, when 46 percent of respondents reported having completed projects on budget and on time. This could be because many construction projects are smaller, Keiser explains.

“We used to see more big megaprojects of over 1 million square feet while now we are seeing more outpatient center construction and renovation,“ he says. “It’s easier to get your arms around.” HFM

Rebecca Vesely is a freelance health care writer based in San Francisco; Suzanna Hoppszallern is senior editor of data and research for Health Facilities Management’s sister publication, Hospitals & Health Networks; and Jamie Morgan is associate editor for Health Facilities Management.