Optimizing health care property portfolios

Accurate and consistent data are vital to optimizing a health care organization’s portfolio and empowering leadership to make proactive and realistic decisions.

The right data will enable smart decision-making related to space utilization, market trends, renewals, debt capacity and many other areas.

When data are easily accessible, decisions can be made based on the entire portfolio versus just one market, region or subsector.

Identity and performance

Every hospital and health system endeavors to build and establish its brand. Some have brand-specific trademarks to stand out within the market. Above all, patient experience can set a brand apart from its competitors.

At times, it may be easy to lose sight of the patient experience outside of direct patient care and customer service. While both are a top priority and should never be overlooked, the overall feel of a space, its appearance and condition play a key role in brand identity. Does the location being considered convey the highest standards synonymous with the organization’s brand?

You may also like |

| Changes in health care real estate |

| Monetizing health care real estate |

| Software helps to unlock health facility data |

|

|

Properly maintaining the physical assets within a portfolio should always be a top priority. That includes the cleanliness of the grounds and parking areas. Communicating expectations of the brand and placing proper checks and balances on the quality and condition of the property will have a direct impact on the patient experience.

Health care providers typically want to get the most value out of the buildings in their portfolio. It is imperative that locations are reviewed and assessed regularly to determine performance. They must look critically at all details of the property’s performance. Is the property in a prime location or away from visible traffic? Knowing if the property is a strong performer and understanding the reasons why can greatly influence renewal decisions.

A consistent goal within any portfolio is to optimize space utilization. To achieve this goal, health care property professionals should begin by mapping where and how people work within the space, recognizing the needs of the market.

Does the organization need more or less space? Is the space configured to meet the organization’s needs? Is the organization able to decrease space and reduce costs? If the organization increases its space, could it increase income by sourcing out the space? For example, the space might be utilized better as a medical group than an ambulatory center.

Pricing must be factored into the equation. Pricing per square foot plays an important role in regard to location, subsector and space utilization. Some questions to consider include:

- How does the location fit within the demands of the local market?

- Where does it stack up against others in the market or subsector?

- What is the pricing per square foot surrounding the location?

- How does it compare when viewed against other locations in the subsector?

Data and analytics

To make informed decisions about portfolio optimization, all relevant data should be gathered from lease agreements or legal documents. All locations start with a legal document that contains the information needed to make decisions. Each location in a portfolio is rich in data, but are they all relevant?

Dollars, dates, options and locations are key data points to identify when extracting data from a legal document. It is important to understand these data points to capture the correct information. Standardized processes and procedures should be implemented to extract the correct data from the document and properly review it for quality, completeness and accuracy. Depending on the severity, inaccurate data can create a trickle effect or an avalanche. A missed critical date can sometimes cost hundreds, thousands or even millions of dollars.

Extracting data can be a tedious and time-consuming process, especially when dealing with large portfolios. This process can be lengthened when the legal documents are scattered throughout the portfolio and inconsistent regarding storage and housing. Some locations may use filing cabinets while others may have electronic copies on a shared server.

Health care property professionals should know how and where their legal documents are stored. They also should know the tracking mechanisms in place to properly execute and account for all of the documents. Standardizing this process throughout the portfolio will increase accessibility for all parties.

When documents are stored and tracked in a centralized location, it is much easier to create a line of sight to the entire portfolio. Centralizing storage ensures a more accurate and thorough data review, which allows for comprehensive analysis and improved decision-making to maximize the return on the portfolio. In addition to viewing the portfolio as a whole, information specific to the subsector, entity or type of building and market trends also should be assessed.

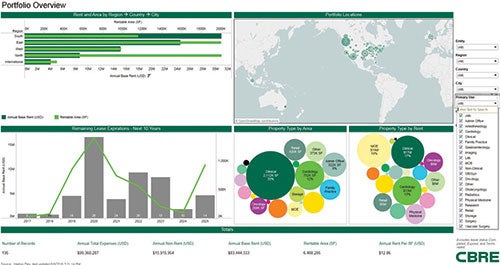

Technology related to the health care sector continues to advance at a rapid pace. There is an increasing focus on visual reporting capabilities that provide immediate insight into data. The ability to filter data by entity, cost center, region and subsector is imperative when evaluating technology options and solutions. Visual and interpretive analytics enable quick analysis of vast amounts of data to deliver high-level relevant reports, which are of primary interest to leadership.

When looking into software that provides visual and interpretive analytics, it’s important to understand what data are important in the organization’s portfolio and how that information is reviewed and utilized. This will aid in making strategic and informed decisions around the portfolios.

Once a database of basic lease portfolio information is developed, most analytics software can be leveraged to create graphical analytical reports using standard portfolio reports developed in a typical lease administration software and exported into a spreadsheet.

After the information is built into enhanced analytical reports, health care property professionals are able to manipulate the data with countless graphs and filters to ensure that they are displaying the relevant data and reviewing them efficiently for the health care portfolio.

Financial management

Understanding a portfolio’s financial position and debt capacity will aid in protecting the organization’s credit rating. Straight-lining rents and other expenses provide a more consistent picture of current obligations. Given that the health care field typically is driven by a rating system that multiplies rents and equipment leases by six or seven to get the debt, this method will provide standards and structure to evaluating finances.

After all obligations have been calculated, the next step is to review expenses. Health care property professionals should make sure that what is accounted for as rent is truly rent and not operating expenses or other miscellaneous charges because rent plays an integral role in debt capacity. When analyzing expenses, property professionals should conduct a market comparison and always seek opportunities to reduce operating costs. Monthly billings should be reviewed and checked against the lease to ensure proper coding and that all billings are within scope.

Just as there are multiple ways to view portfolio data, the same is true from a financial aspect. In the health care sector, financials are commonly broken down by cost center and entity. Once aware of what drives portfolio financials, viewing them becomes much easier. Interpretive analytical reporting can play a huge part in an organization’s financials. Evaluation at a high level will reveal trends within the portfolio, cost center or entity. The laggards within the portfolio, by a certain subsector or region, quickly will become apparent. Once identified, the resolution process can begin.

Controlling costs is one of the most important aspects in managing a portfolio. While overall costs may be outside of a property professional’s control, they should identify what they can manage and focus on it. Tenant billbacks affect a portfolio’s profitability. Health care property professionals should review the legal document and understand the allowances accounted for within it. Extracting all of the key data points accurately will provide ease when researching this information for tenant billings.

Property professionals should make sure all billings (e.g., scheduled rent increases, maintenance, operating expenses, etc.) are to the full extent of the lease. With the proper controls and monitoring in place, it is possible to capture all scheduled rent increases and other charges allotted for in the lease.

The same holds true for landlord billings. Understanding which charges are the tenant’s responsibility and which are the landlord’s responsibility can impact the overall costs of the portfolio. Leases often call for a pro rata share of expenses based on the occupied square footage of that space. It sounds simple enough, but what if there has been an increase or decrease in the square footage and the landlord billing does not properly account for the change in the pro rata share?

The same is true with one-time charges like HVAC repairs, parking passes, key copies and lock changes. Health care property professionals should review the document to know the maximum allowable billing per occurrence on the HVAC calls. Does the lease allow for a certain number of parking passes, lock changes or key copies without charge or penalty? While these charges may seem small when looked at individually, they quickly add up. All billings should be properly reviewed in accordance with the legal documents to avoid errors that can end up costing thousands of dollars.

Annual common area maintenance reconciliations can result in large monetary exchanges, depending on the building and the terms of the lease. Checks and balances are especially crucial in the review of year-end reconciliations. Property professionals should know what is allowed in the lease. They should identify whether there is a base year, what it is and if there is an expense cap. Having this information centralized and easily accessible will make this process less grueling.

Additionally, they should understand the difference between controllable and uncontrollable expenses and how they affect revenue. They should always review whether the landlord is billing in accordance with the lease or whether they bill based on actuals alone.

A driving factor

In the current competitive market, portfolio optimization will be a driving factor in the success of a health care organization’s brand. This provides a holistic and strategic approach to portfolio management.

Timely and accurate analysis of data enables a health system to quickly identify and react to market trends. Health care property professionals should invest the time and resources necessary to implement a process that enables accurate decision-making and delivers maximum return on investment.

Brooke Gary is director for portfolio services operations and Deatra Longo is manager, lease administration for portfolio services operations, at CBRE, Memphis, Tenn. They can be reached at brooke.gary@cbre.com and deatra.longo@cbre.com, respectively.